Medicare Advantage (MA) plans work hard to be highly responsive to member needs, whether it’s meal delivery, transportation, home modification or other in-home supplemental services. To deliver a five-star experience, and improve CAHPS scores, many health plans have invested in their own culture of healthcare delivery, ensuring that their care navigators have the tools they need to be successful.

Recognizing that service coordinators and navigators are on the front lines of communication, these organizations find that job satisfaction spills over into positive touch points with members.

In addition, these health plans understand that the culture mindset extends to working with their benefit and service provider networks, ensuring that these organizations have a friction-less experience delivering services to members. As MA plans add members and enter new markets, a major challenge is sustaining a seamless benefit and service delivery model in a personalized manner, as it typically means new providers, new navigators, and of course, new geographies.

Why Focus on CAHPS Scores?

Why Focus on CAHPS Scores?

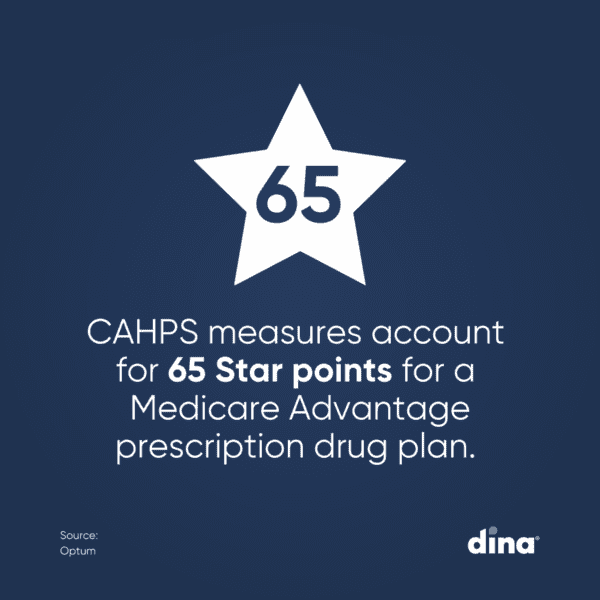

A Consumer Assessment of Healthcare Providers and Systems (CAHPS) survey is the gold standard for assessing consumer satisfaction with the quality of their healthcare, including hospital stays, outpatient care, home care, and hospice services.

The Agency for Healthcare Research and Quality (AHRQ) publishes these surveys to help healthcare organizations gain insight into consumer preference, quality, and satisfaction. This allows health plans to improve the quality of services offered, think critically about navigation experiences and benefits offered, and ultimately, member outcomes. However, since these surveys are based on member perceptions, it’s often a challenge to improve scores.

As the industry transitions from a fee-for-service model to a value-based model, the points of differentiation between health plans are narrowing. Members are making more informed health care decisions and rely on these publicly available survey results in deciding where to receive care. The plans that can improve on measures that have traditionally been difficult to move — like CAHPS — will likely end up on top.

How to Improve CAHPS Scores

To improve CAHPS scores, plan managers should focus on a few essential questions:

- Which members can benefit from services like food, transport, and in-home services, and are they eligible?

- Which providers meet member requirements?

- What are their capacities and availability? Can services be rendered in a reasonable timeframe? In many cases, plans are constrained with staffing shortages that delays benefit fulfillment.

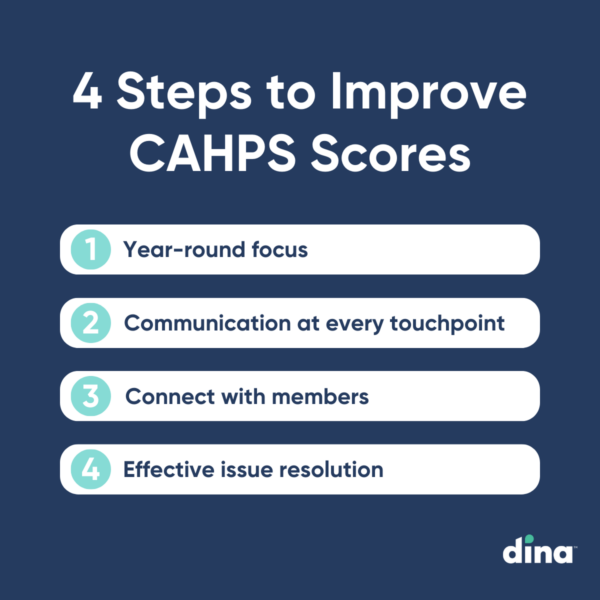

Asking these questions will help health plans decide what their members need, whether or not to design flexibilities or SSBCI offerings, and how to fulfill them in a way that continues to improve CAHPS and STAR ratings. In addition, here are some key areas for improvement:

Customer service Approach every member interaction with a focus on service.

Connection Establish and maintain a connection with your members, especially those who enroll online and may get lost in the outreach process.

Communication Evaluate communication at every member touchpoint to ensure it is consistent and high-quality.

Resolve Issues Put in place a process for resolving member issues that includes communication, escalation, issue resolution and success measurement.

Challenges to Improving CAHPS Scores

Addressing and improving CAHPS scores requires the right data to make cost-effective and meaningful member engagement decisions. But there are several challenges to understanding why health plan contracts receive specific scores.

First, the official CAHPS survey only shows contract-level performance and does not provide insights into member-level experiences. In addition, it is difficult to identify members who would positively impact CAHPS scores and motivate them to share feedback.

According to research from Healthmine, the lack of insight speaks to two additional, interconnected challenges: declining response rates and disparities in care.

The National Committee for Quality Assurance (NCQA) reports that response rates have declined below 40% for MA plans, and 20% for Medicaid and commercial health plans. In addition, AHRQ, which designs the CAHPS survey, acknowledges that response rates for underserved groups are lower than national averages.

As a result, current CAHPS scores do not accurately reflect the experiences of diverse communities and limit the ability for plans to deliver equitable quality of care. Plans with high populations of low-income and diverse members, such as Medicaid and Children’s Health Insurance Programs, are especially impacted by these issues. Increased pressure on MA plans to reduce health disparities and improve member experiences also makes this a major challenge for Star Ratings teams.

Comparing CAHPS Scores to Benchmarks

The CAHPS database gathers survey results from health plan survey users across the country and then reports aggregated data in an online reporting system that all survey users can use to identify strengths and weaknesses in their own performance. In the online reporting system, you can find the following:

- Frequencies show the distribution of scores for all response options and allow users to run custom displays by selected respondent and plan characteristics.

- Bar charts display a graphical distribution of survey results that show the top, bottom, and middle response categories.

- Trending displays results across the two most recent years of data for composites, overall ratings and individual items.

- Report builder allows users to create custom downloadable reports.

Participating in the CAHPS database lets you view your organization’s results compared to benchmarks drawn from national, regional, and product-type distributions.

Improving CAHPS Scores Using Technology

Health plans are becoming innovative in unlocking new benefits to meet members where they are on their journey to help them live their best life. According to Dina CEO Ashish V. Shah, there is an opportunity to organize these new benefits, alongside the

traditional home-oriented services like home health and hospice, into a centralized digital marketplace. The goal is to drive satisfaction for both coordinators and members, as there is one place to navigate benefits that are right for the individual at that moment.

New creative benefits are being turned on with impressive speed. “Looking into the future, the healthcare market will continue to innovate because doing so is critical for meeting the demands of the membership and increasing satisfaction on the part of plan managers,” he said.

MA plans that have embraced innovation and invested in the culture of care delivery often find a direct correlation to improved CAHPS scores. Additionally, organizations that extend thatl mindset to service providers make it easier for everyone to deliver exceptional care.

PACE Members Expect Quick Activation of Home-Based Services.

Does Your Plan Deliver?

See how easy it is to streamline access to medical and non-medical

home-centered benefits, support your centers, and quickly measure results.