Medicare Advantage (MA) enrollment has been on a steady climb for the past two decades, following changes in policy designed to encourage a robust role for private plan options in Medicare. In 2023, 30.8 million people are enrolled in a MA plan, accounting for more than half of the eligible Medicare population, and $454 billion of total federal Medicare spending. These Medicare Advantage trends reflect the program’s continued growth and popularity. The average Medicare beneficiary in 2023 has access to Medicare Advantage plans, the largest number of options ever.

Medicare Advantage Trends Across the Country

The share of Medicare beneficiaries enrolled in Medicare Advantage varies widely across counties. In 2023, nearly one-third (31%) of Medicare beneficiaries live in a county where at least 60% of all Medicare beneficiaries are enrolled in MA plans, while 10% live in a county where less than one-third of all Medicare beneficiaries are enrolled in MA plans. The variation in county enrollment rates could reflect several factors, such as differences in firm strategy, Medicare payment rates, number of Medicare beneficiaries, healthcare use patterns, and historical Medicare Advantage market penetration.

In addition, MA enrollment is concentrated among a small number of firms. UnitedHealthcare and Humana account for nearly half of all MA enrollees nationwide, and in nearly a third of counties (32%; or 1,013 counties), these two firms account for at least 75% of MA enrollment.

To encourage MA plans to compete for members based on quality, the Affordable Care Act (ACA) established a quality bonus program that increases payments to plans based on a five-star rating system. Star ratings are used to determine two parts of a Medicare Advantage plan’s payment: whether the plan is eligible for a bonus, and the portion of the difference between the benchmark and the plan’s bid that is paid to the plan. Since 2015, plans that receive at least four stars have their benchmark increased.

In addition, bonus payments to MA plans have increased sharply:

- Federal spending on MA bonus payments has increased every year since 2015 and will reach at least $12.8 billion in 2023, an increase of nearly 30% ($2.8 billion) since 2022.

- Most MA enrollees are in plans that are receiving bonus payments in 2023.

- The average bonus payment per enrollee is highest for employer- or union-sponsored MA plans ($460) and lowest for special needs plans ($374).

Opportunity to Provide Home-Centered Services

MA plans have long been able to offer “primarily health-related” supplemental benefits not covered by traditional fee-for-service Medicare, such as vision and dental coverage. As care continues to move to the home and community, there is a clear opportunity for MA plans to provide home-centered services that are attractive to new members and make it easier for members to age in place.

These types of supplemental benefits have been an important differentiator among MA offerings, allowing people to identify plans that offer benefits and services that meet their needs.

MA Plans are Booming:

How Will You Stay Competitive?

Download our report “Home Benefits Surge in Popularity Among Medicare Advantage Plans” to learn more about leveraging supplemental benefits to increase member satisfaction, retention and STARs.

In our new report: Home Benefits Surge in Popularity Among Medicare Advantage Plans: Trends and Opportunities to Increase Member Satisfaction, Retention and Stars” we cover this and much more:

- The Meteoric Rise of Medicare Advantage

- 3 Medicare Advantage Trends in Supplemental Services

- Delivering on Supplemental Benefits

- Navigating Challenges in a Tight Labor Market

- What’s Next for Members?

3 Medicare Advantage Trends

The most exciting part about this growth and momentum is that more plans will use supplemental benefit programs to innovate and try new approaches that can move the needle on member wellness. Members have no shortage of options available to them and many plans are designing benefits tailored to specific communities or condition-specific populations, where they believe they can make the biggest impact. Three trends we’re watching include the continued growth in supplemental benefit programs across the country, the rapid adoption of in-home support services by health plans, and support for family caregivers.

Growth in Supplemental Benefits

Growth in Supplemental Benefits

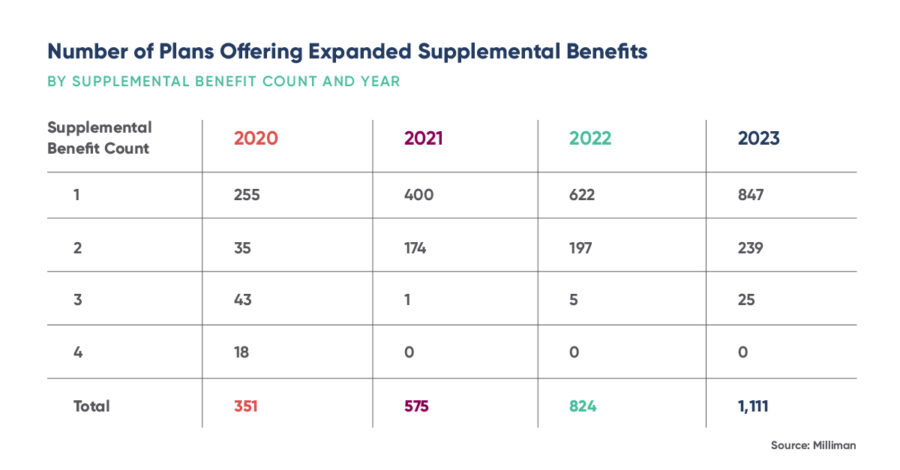

Several trends have emerged from the evolving MA landscape. First, regulatory changes have expanded what MA plans can offer as supplemental benefits to include non-medical services such as transportation, meal delivery, and home modification. As a result, the number of MA plans to offer at least one of the recently expanded supplemental benefits jumped more than 35% from 2022 to 2023.

According to KFF, since 2006, the role of MA has steadily grown. In 2022, more than 28 million people were enrolled in an MA plan, accounting for nearly half of the eligible Medicare population. This represents 55%, or a whopping $427 billion, of total federal Medicare spending.

Last year the average Medicare beneficiary had access to 39 MA plans, the largest number of options available in more than a decade.

Between 2021 and 2022, total MA enrollment grew by about 2.2 million beneficiaries or 8% – a slightly slower growth rate than the prior year (10%). However, the Congressional Budget Office (CBO) projects that the share of all Medicare beneficiaries enrolled in MA plans will rise to 61% by 2032.

Anne Tumlinson, CEO of ATI Advisory, cites three trends. “First, is just the sheer growth in the amount of dollars being spent on supplemental benefits,” she said. Medicare per-person spending on supplemental benefits has been growing, in part, due to investment in new categories of primarily health-related benefits and special supplemental benefits for the chronically ill.

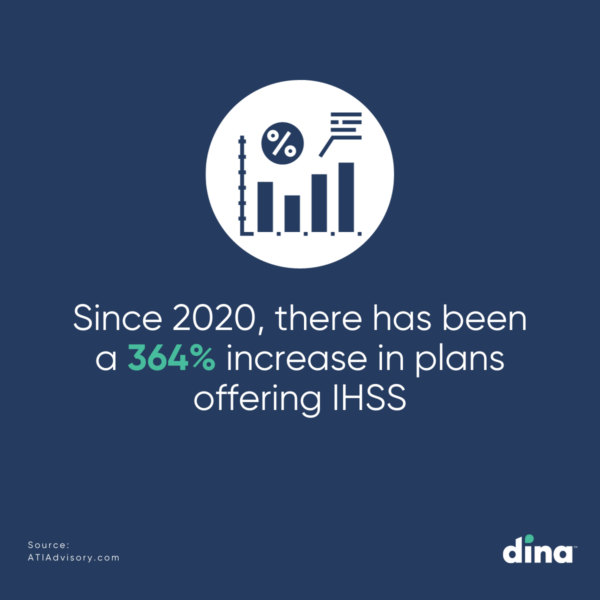

IHSS is Fastest Growing Benefit

Second, is where that money is being spent. “Of all of the expanded benefits that are available for plans to offer above and beyond the traditional dental and vision, in-home support services (IHSS) is among the fastest growing in terms of the number of plans offering it.

In-home benefits are provided by health plans to address gaps in the traditional healthcare system. These benefits are often offered as part of a flexible package designed to support individual member needs and overall health. In addition to meeting those needs, many plans find that these benefits promote satisfaction and retention among their members.

ATI Advisory research shows that large health plans have rapidly expanded their in-home services coverage. Smaller plans that have never offered such services have begun doing so. Since 2020, there has been a 364% increase in plans offering IHSS, from 283 plans to 1,314 in 2023. There has been a 320% increase in caregiver support service offerings, from 134 plans to 563 plans.

There has also been a 1,215% increase in plans offering social needs benefits, from 34 plans in 2020 to 563 now. All of these supplemental benefits are ones that home care providers could theoretically fulfill.

Payers have a massive opportunity to shift care into the home through plan design, and then their own care navigation, to ensure timely access to those home-based benefits. By being in the home, the payer will delight members with better delivery, but also unlock volumes of new data that highlights the ongoing needs of a member (and their family). Often those needs are non-medical in nature and can often address challenges with health equity and other SDOH factors.

Focus on Family Caregivers

Third, is a focus on family caregivers, which is the primarily health-related benefit category that grew the fastest from 2022 to 2023. Support for caregivers of enrollees more than tripled from 2021 to 2023.

The U.S. Department of Health and Human Services (HHS) estimates that around 53 million people provide some sort of assistance every year to a person close to them as they age, or due to a disability or chronic health condition. This takes on renewed importance as widespread workforce shortages continue to challenge the healthcare industry, including home and community-based service providers. Building caregiving capacity and determining who has availability so that members can access benefits in a timely manner is a growing problem that isn’t going away any time soon.

The solution to attracting and retaining this sector requires more than just rethinking traditional workforce and business models. Part of the solution needs to be to provide better support to frontline caregivers.

In response, HHS introduced its first-ever national strategy plan to support family caregivers. The 2022 National Strategy to Support Family Caregivers plan lays out nearly 350 actions the federal government needs to take in order to make the lives of family caregivers easier as more adults choose to age at home. The goal is to address resource opportunities for the health, well-being, and financial security of family caregivers.

Earlier this year, a group of lawmakers recently introduced the Supporting Our Direct Care Workforce and Family Caregivers Act which not only focuses on improving conditions for professional caregivers, but family caregivers as well. The introduction of this legislation is an acknowledgment that professional and family caregivers require federal investment.

If passed, the bill would provide grants to states and other relevant entities for initiatives that are meant to strengthen, educate, and retain the caregiver workforce. On the family caregiver side, the bill also calls for the creation of grants aimed at providing educational and training support for these individuals.

Changing Regulatory Environment

In other Medicare Advantage trends, the most sweeping set of regulatory changes to the program since the Medicare Modernization Act of 2003 will go into effect in the next three years, affecting rates, risk adjustment, Star ratings, and Part D.

For calendar year 2024, CMS reduced payment rates by 1.24% in response to a decline in average MA Star ratings, which resulted largely from expiring COVID-19 provisions and scheduled measure adjustments. Star ratings reached a record high in 2022, with 90% of members in plans rated with four or more Stars; that number fell to 72% in 2023, McKinsey reports.

Another upcoming change in MA Star ratings hinges on a critical factor – health equity. Starting with the 2027 Star ratings, the new Health Equity Index (HEI) will reward high measure-level scores with low-income subsidy, dual eligible, and disabled enrollees.

As health plans prepare for the change, many are investing in programs that address the social determinants of health impacting older members such as income disparities, loneliness, and isolation. These investments can pay off in several ways including delivering a more personalized experience, closing gaps in clinical care, and improving outcomes for an aging population with more care needs. It can also create a competitive edge over other health plans competing for the same market share.

Improving Supplemental Benefit Delivery

Another competitive advantage is making it easier for members to access services and engage with the health plan. Navigating the healthcare system is challenging, and members are frustrated when they don’t know where their benefits are or how to access different services.

We found that progressive health plans are re-imagining how they work with providers and the organizations they contract with to make it easier to coordinate services and unlock a great member experience. In the future, the quality of members’ experiences will be a core component of competitive differentiation.

In addition, member preferences for engaging with MA plans are fundamentally changing and they expect the same customer-centric digital engagement experiences offered by many retailers and technology providers.

For example, of the more than 7 million beneficiaries who enrolled in a new MA plan in 2022, more than one-third (about 2 million) used an e-broker, representing a meaningful shift to digital channels compared with even five years ago.

Beyond shopping, more than two-thirds of members reported using technology in the onboarding journey to understand benefit coverage, manage prescription drugs, and navigate physician networks.

Members have no shortage of options available to them and they will shop around for the plan that delivers the benefits that best meet their needs, particularly if they require multiple services to age in place or manage chronic conditions. In response, plans are becoming innovative in how they unlock new benefits to meet people where they are on their journey to help them live their very best lives.

How does your plan stack up to your competitors? Download our report to find out how you can use supplemental benefit programs to improve member satisfaction, increase member retention, and boost Star ratings. Payers have an opportunity to be invited into the homes of those they serve, they should not take that lightly. It’s a win-win for all involved.

MA Plans are Booming:

How Will You Stay Competitive?

Download our report “Home Benefits Surge in Popularity Among Medicare Advantage Plans” to learn more about leveraging supplemental benefits to increase member satisfaction, retention and STARs.

Growth in Supplemental Benefits

Growth in Supplemental Benefits